TAX INFORMATION

TAX IMPACT

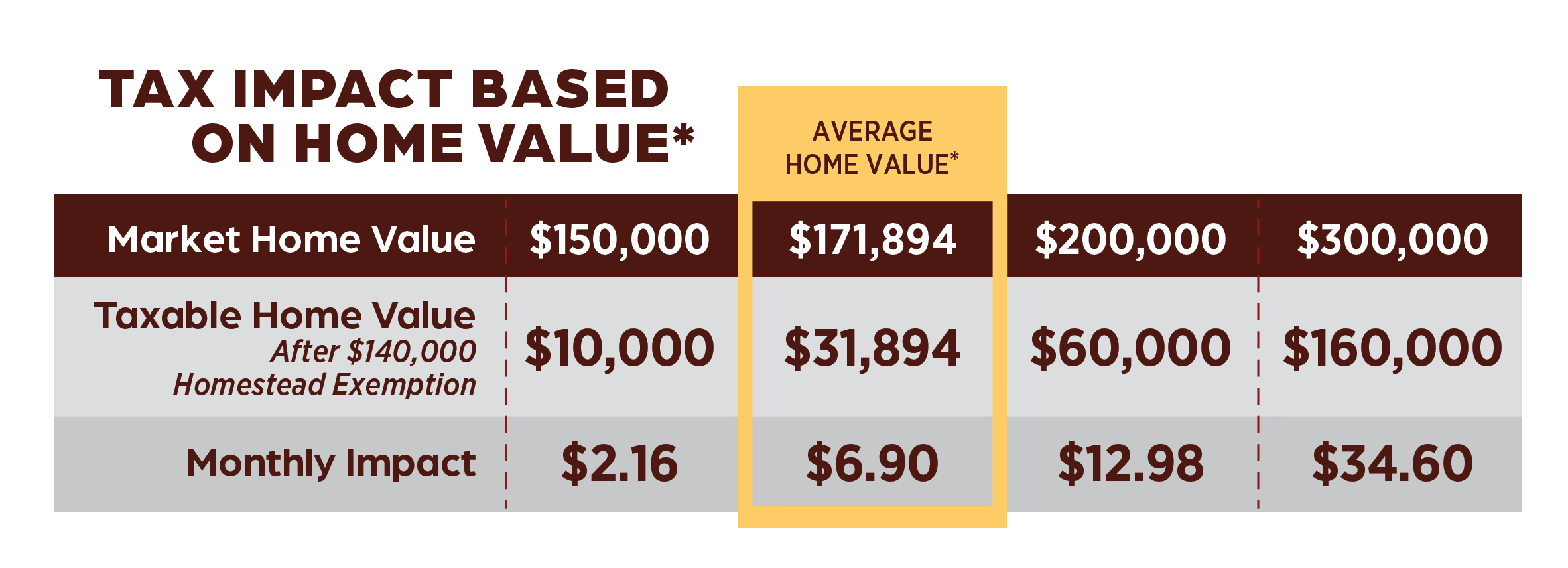

If both propositions pass, the district projects a tax rate impact of $0.2595 (25.95 cents).

*ALL TAX IMPACT PROJECTIONS INCLUDE A $140,000 HOMESTEAD EXEMPTION PROPOSED FOR NOVEMBER 4, 2025. IF APPROVED, ALL TEXAS HOMEOWNERS WOULD BE ELIGIBLE FOR A $140,000 STATE HOMESTEAD EXEMPTION ON SCHOOL TAXES—AN INCREASE OF $40,000 FROM THE CURRENT EXEMPTION.For the average home in Cooper ISD valued at $171,894, that would be $6.90 a month.

Learn more about the district’s tax configuration, previous tax rate history, and more below.

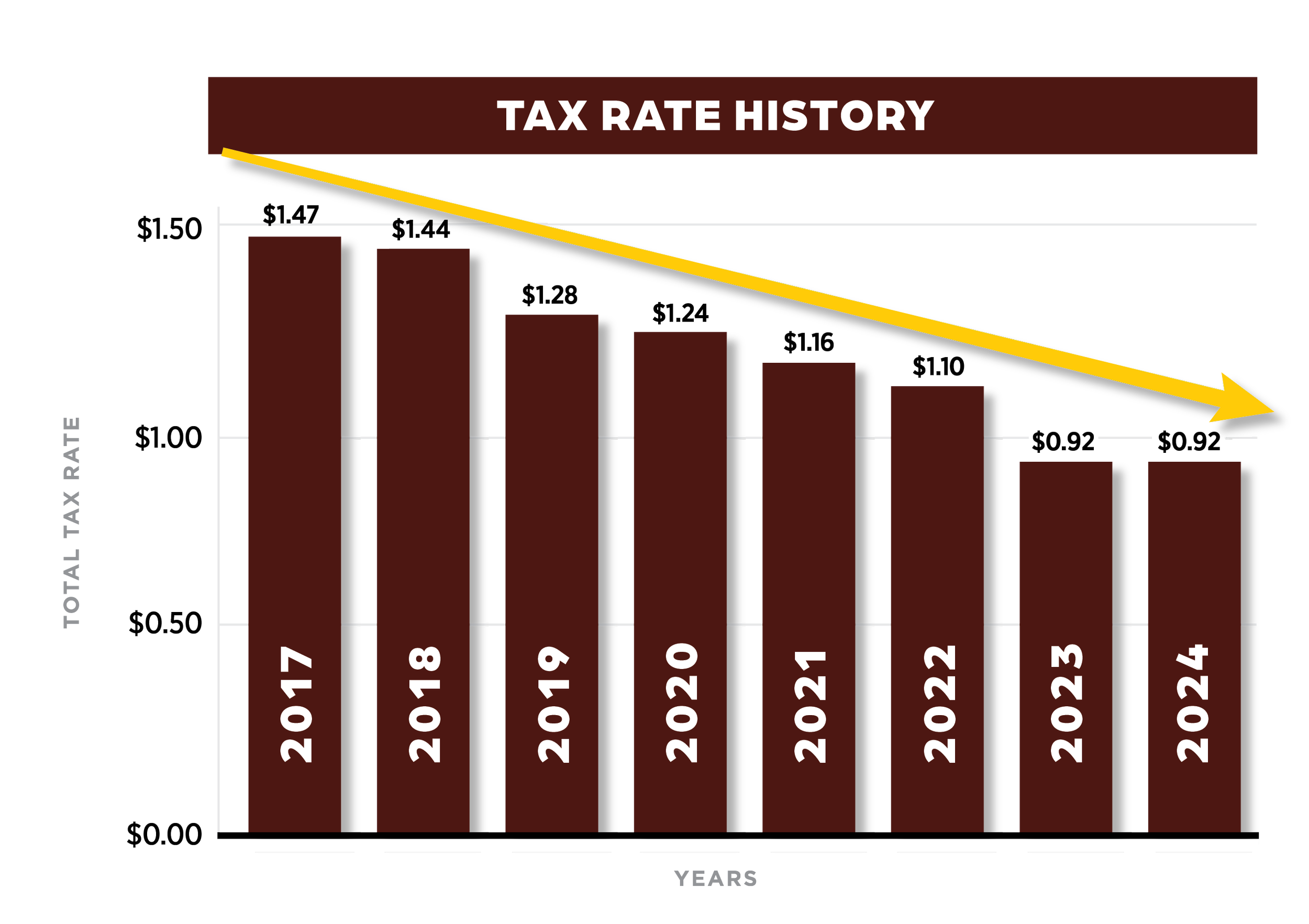

TAX History

Cooper ISD’S total tax rate has DECREASED BY $0.55 since 2017.

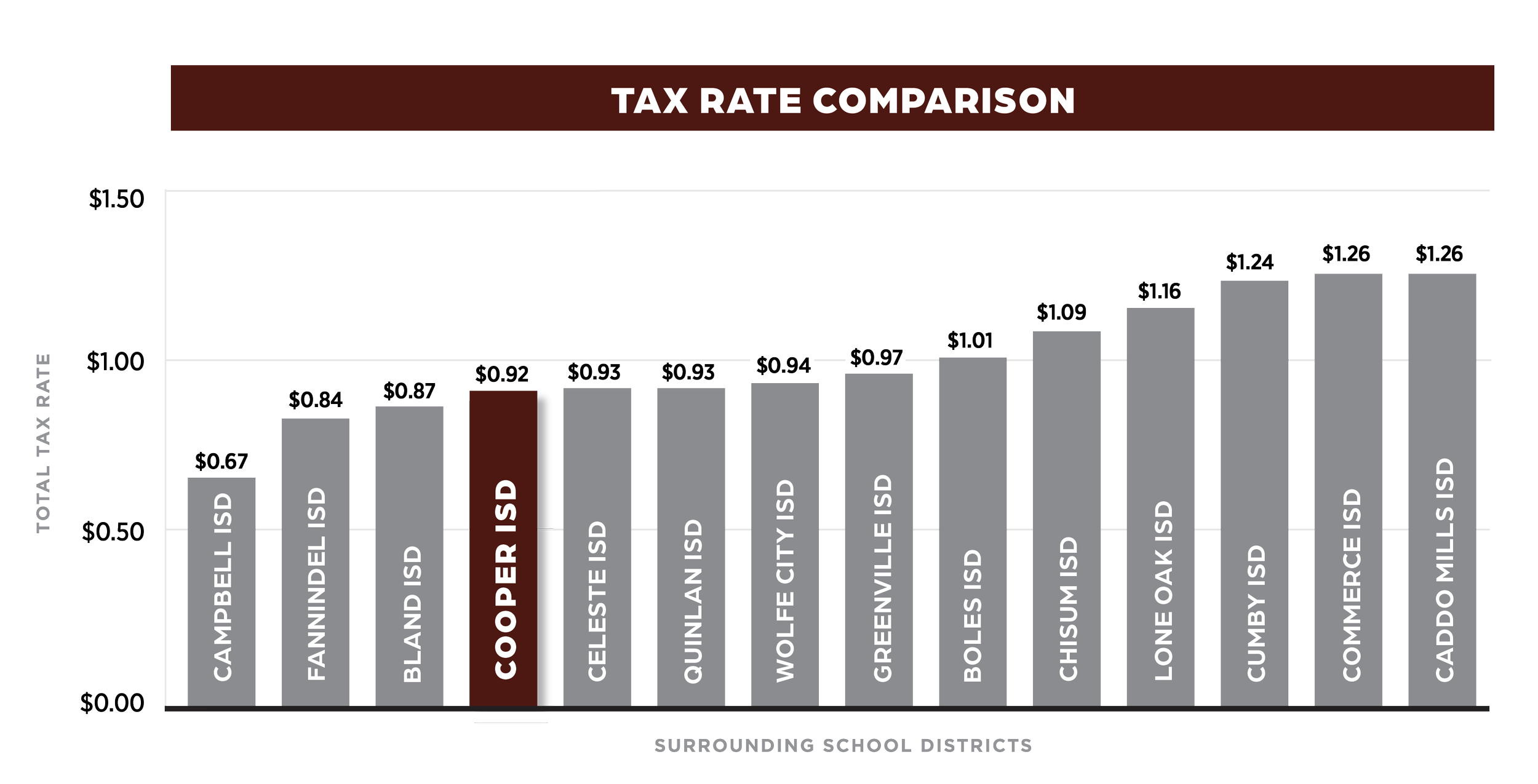

Cooper ISD currently has the fourth lowest tax rate compared to districts in the surrounding area.

Want to learn more about school finance & how it works?

Calculate Your Monthly Impact

ESTIMATED MONTHLY IMPACT

$0.00

Important Information

This calculator takes into account the $140,000 homestead exemption afforded to Texas residents who apply for it and allows for two selections: the estimated tax impact and the current appraised value of your home (please keep in mind that the appraised value is not the same as the market value). If you qualify for an age 65+ or disabled person residence homestead exemption, the school district taxes on that residence homestead cannot increase as long as you own and live in that home.

Voters 65+ or disabled

Voters 65+ or Disabled Tax exemption

If you qualify for an age 65+ or disabled person residence homestead exemption, the school district taxes on your residence homestead cannot increase above your approved tax ceiling—as long as you own and live in the home and do not make any improvements/additions. The tax ceiling is the amount you paid in the year you qualified for the exemption. While your school district taxes may decrease, they cannot increase above your tax ceiling.

Why will my ballot read “THIS IS A PROPERTY TAX INCREASE”, if I have an approved homestead exemption?

Texas legislature passed laws in 2019 requiring all school bond elections to include the following language on the ballot: “THIS IS A PROPERTY TAX INCREASE”. The state mandates all bond ballots to include this language, regardless of what individual exemptions each voter may have.